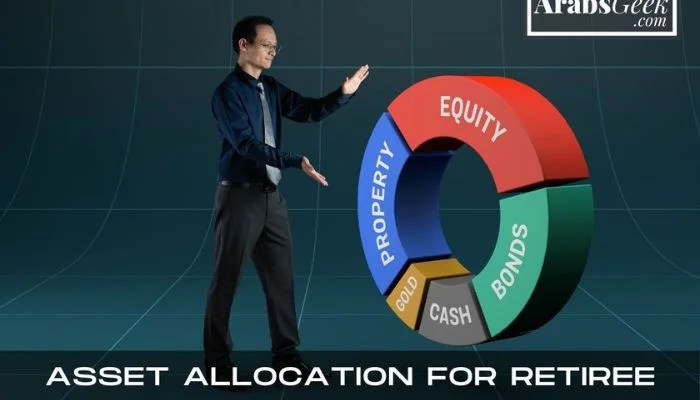

Introduction | Asset Allocation For Retiree

Retirement marks a significant milestone in one’s financial journey, and it often calls for a shift in investment strategy to ensure a secure and comfortable future. One crucial aspect of managing your investments during retirement is determining the appropriate asset allocation. This article will discuss the importance of asset allocation, the unique considerations retirees should make, various strategies for asset allocation in retirement, and the importance of rebalancing your portfolio. So, let’s explore the world of asset allocation for retirees and help you make the most of your golden years.

Table of Contents

What is Asset Allocation?

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. The primary goal of asset allocation is to balance risk and reward by selecting a mix of assets that align with your risk tolerance, investment goals, and time horizon.

For any business enquiry, you can contact us at ArabsGeek.com

For more of such financial articles, Consider visiting our sister website at EntrepreneursPilot.com

The importance of asset allocation | Asset Allocation For Retiree

Asset allocation plays a critical role in determining your portfolio’s overall performance and risk level. A well-diversified portfolio can help protect against market fluctuations and provide more consistent returns over time. By investing in various asset classes, you reduce the impact of any single investment or market sector, ensuring that your portfolio can withstand market turbulence.

The role of risk tolerance and time horizon

Your risk tolerance and time horizon are essential factors to consider when determining your asset allocation. Risk tolerance refers to your willingness and ability to accept investment losses in pursuit of higher returns. Your time horizon is the period between now and when you’ll need the money you’re investing. As a retiree, your time horizon is typically shorter, and your risk tolerance may be lower, necessitating a more conservative approach to asset allocation.

Unique Considerations for Retirees

Retirees face specific challenges and priorities when it comes to asset allocation. Here are some factors to consider when adjusting your investment strategy during retirement:

Changing risk tolerance | Asset Allocation For Retiree

As you enter retirement, your risk tolerance may decrease, as you have less time to recover from market downturns. This may require a more conservative asset allocation, with a higher focus on income-producing and less volatile investments.

Ensuring income in retirement

Retirees rely on their investments to provide a steady income stream during retirement. Therefore, your asset allocation should focus on generating sufficient income to cover your living expenses while preserving your capital.

Inflation protection | Asset Allocation For Retiree

Inflation can erode the purchasing power of your retirement savings over time. To protect against inflation, retirees should consider including investments that have the potential to outpace inflation, such as stocks or inflation-protected bonds.

Estate planning

Retirees should also factor in their estate planning goals when determining their asset allocation. This may involve adjusting your investments to minimize taxes, provide for heirs, or support charitable giving.

The Three Key Components of Asset Allocation

There are three main asset classes that retirees should consider when determining their asset allocation:

Stocks | Asset Allocation For Retiree

Stocks represent ownership in a company and can offer the potential for capital appreciation and dividend income. While stocks tend to be more volatile than other asset classes, they can provide higher long-term returns and help protect against inflation.

Bonds

Bonds are debt securities issued by corporations or governments. They pay periodic interest and return the principal at maturity. Bonds are generally less volatile than stocks and can provide a steady income stream, making them an essential component of a retiree’s portfolio.

Cash and cash equivalents | Asset Allocation For Retiree

Cash and cash equivalents include short-term, highly liquid investments, such as money market funds and certificates of deposit (CDs). While these investments provide low returns, they offer stability and easy access to funds, making them suitable for emergency reserves or short-term needs.

Asset Allocation Strategies for Retirees

There are several strategies that retirees can employ when determining their asset allocation. Here are three popular approaches:

The Bucket Approach

The bucket approach divides your portfolio into separate “buckets,” each with a different investment objective and time horizon.

How it works | Asset Allocation For Retiree

Typically, the first bucket contains cash and cash equivalents to cover near-term living expenses, the second bucket includes bonds and other income-producing investments for intermediate-term needs, and the third bucket holds stocks for long-term growth.

Pros and cons

The bucket approach can help ensure that you have sufficient liquidity to cover your expenses and reduce the need to sell investments during market downturns. However, it may require more active management and periodic rebalancing to maintain the desired allocation.

Target-date funds | Asset Allocation For Retiree

Target-date funds are a type of mutual fund or exchange-traded fund (ETF) that automatically adjusts its asset allocation based on a predetermined retirement date.

How they work

As the target date approaches, the fund gradually shifts its allocation from a more aggressive mix of stocks to a more conservative mix of bonds and cash.

Pros and cons | Asset Allocation For Retiree

Target-date funds offer a hands-off approach to asset allocation, making them suitable for retirees who prefer not to manage their investments actively. However, they may not be tailored to your specific risk tolerance or financial goals, and their fees can be higher than other investment options.

Customized asset allocation

A customized asset allocation is a tailored investment strategy based on your unique financial goals, risk tolerance, and time horizon.

How to create a customized plan

You can work with a financial advisor to develop a personalized asset allocation or use online tools and resources to create a plan based on your specific needs.

Pros and cons

Customized asset allocation offers a tailored approach that considers your individual circumstances and goals, potentially leading to better long-term results. However, it may require more active management and a deeper understanding of investing principles.

Rebalancing Your Portfolio | Asset Allocation For Retiree

The importance of rebalancing

Rebalancing is the process of periodically adjusting your portfolio’s asset allocation to ensure it remains aligned with your financial goals and risk tolerance. It involves selling investments that have grown in value and buying investments that have declined in value to maintain your desired allocation.

How often to rebalance

There is no one-size-fits-all answer to how often you should rebalance your portfolio. Some investors choose to rebalance annually, while others may do so quarterly or semi-annually. Additionally, some investors opt for a threshold-based approach, rebalancing when their allocation deviates from their target by a specific percentage.

Conclusion | Asset Allocation For Retiree

Asset allocation is a critical component of a retiree’s investment strategy. By carefully considering your risk tolerance, time horizon, and financial goals, you can develop an appropriate mix of stocks, bonds, and cash that balances risk and reward. Whether you choose the bucket approach, target-date funds, or a customized asset allocation, remember to periodically rebalance your portfolio to ensure it remains aligned with your objectives. By thoughtfully managing your asset allocation, you can help ensure a secure and comfortable retirement.

Frequently Asked Questions (FAQs)

Q1: How should a retiree’s asset allocation differ from that of a younger investor?

A retiree’s asset allocation should generally be more conservative than that of a younger investor, with a higher emphasis on income-producing and less volatile investments like bonds and cash equivalents. This is due to a retiree’s shorter time horizon and potentially lower risk tolerance.

Q2: How can retirees protect their portfolios against inflation?

Retirees can protect their portfolios against inflation by including investments that have the potential to outpace inflation, such as stocks or inflation-protected bonds (like Treasury Inflation-Protected Securities, or TIPS).

Q3: How often should retirees rebalance their portfolios?

There is no set rule for how often retirees should rebalance their portfolios. Some choose to rebalance annually, while others may do so quarterly, semi-annually, or when their allocation deviates from their target by a specific percentage.

Q4: What is the role of a financial advisor in determining a retiree’s asset allocation?

A financial advisor can help retirees develop a customized asset allocation based on their unique financial goals, risk tolerance, and time horizon. They can also provide guidance on rebalancing, tax-efficient strategies, and estate planning considerations.

Q5: Are target-date funds a suitable option for retirees?

Target-date funds can be a suitable option for retirees who prefer a hands-off approach to asset allocation. However, they may not be tailored to your specific risk tolerance or financial goals, and their fees can be higher than other investment options. It’s essential to evaluate your individual needs and preferences before choosing a target-date fund.